- Chandigarh UT

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

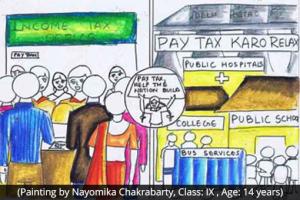

Inviting innovative ideas and suggestions on tax policy and administration

Start Date :

Sep 18, 2015

Last Date :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

One of the key priorities of the Government is to provide a non-adversarial and a responsive tax administration with the main objective of creating an environment conducive for ...

CIBIL WAS A VERY INNOVATIVE IDEA BROUGHT UPON BY PREVIOUS GOVERNMENTS, BUT SINCE IT HAS PROVEN TO BE THIS EFFECTIVE , AND NOW IT POSSESS VERY SENSITIVE INFORMATION OF ALMOST 20% CITIZENS OF OUR COUNTRY,

WILL IT NOT BE A GOOD IDEA TO HAVE OUR OWN CIBIL TYPE AGENCY, AND NOT DEPENDENT ON A FOREIGN ENTITY TO SERVE OUR FINANCIAL INSTITUTIONS . CIBIL IS A FOREIGN COLLABORATION COMPANY IN ASSOCIATION WITH "DUN & BRADSTREET AND TRANSUNION " WORKING IN INDIA, WHEN WE ARE SO KEEN ON "MAKE IN INDIA"

In the case of an assesse offering income from house property, 30% deduction is allowed u/s 24 towards repairs/maintenance. However, in the case of employees who reside in own house entire HRA is taxed subject to the conditions laid down in Sec 10(13A). It would be highly desirable if 30% deduction is allowed on sum so calculated u/s 10(13A) because the employees should not be deprived of the deduction on account of repairs/maintenance. Request Hon'ble FM Sir to kindly consider.

It is really impossible to track Income Tax on local shopkeeper unless people are not asking for original bill

Original Bill again puts additional cost to consumer

If govt developed reimbursement model for additional charged amount to consumer using their AADHAR CARD then they will be able to get local-shopkeeper into their TAX-net

Reimbursement can be done through the additional govt revenue

It'll be almost similar to Gas subsidy

And mandatory original bill for consumers else penelty

To widen the tax net , innovatuve methods must be explored , there must be some curb upon farmers, they do not pat any taxes, but are always in center of government policies.

NPS's maturity proceedings can be easily made tax free as a better part is invested n equity and long term capital gain on equity investment is tax free , going through that logic nps return can be treated as return from hybrid mutual fund and can be taxed at par with hybrid mutual funds. Yes , pension earned with nps corpus may get taxed. But not the whole accumulated fund of nps

Interest on income tax refund must be exempted from Income Tax... it is like you are paying interest, (much lesser than prevailing loan rates) on my money kept with you, (not with my happy consent) and when i get my money back , i have to pay you back tax on that interest earned . Either you reduce TDS rates for those who are getting Refund in earlier year, or pay higher interest, or "exempt the interest, like exepmtion done on savings account interest"

NPS.. a good social security scheme for unorganized sector.. It used to contribute 1000.00 from govt's side in subscribers account for first 2-3 years, it was a better incentive to lure more and more subscribers, but currently it is discontinued.. it should be started again

before applying for PAN, one thinks of possibility, of ending up start paying income tax. there must be some incentive in applying for PAN . Like say "for first year itr, tax abatement of RS 1k or so."

These kind of incentives are seen on online shopping websites, "your first order with us.. have 100 Rs off on any purchase"

Our taxation about DIVIDEND Capital Gain Is no way different than what is in USA.When thie decision was our computerisation was infancy but today it is far advance.The Suggestion made earlier will not change much the DIV tax collection or on capital gain.Rather it will increase with passing of time and Companies will have funds for investment,and could consider higher distribution of Div per share.The real beneficiary of present rule will have to pay taxes.Stock sale market behavior up& down.

A suggestion is that let the Dividend Tax be taxable at the Investor level, with retail investors exempt from it (eg Dividend upto Rs 3000/- is exempt), and higher dividends being deducted @Tax rate by the company and given to the Govt.

This will allow the company to have a) more funds to fuel growth through their own profits, b) curb profiteering by a few investors and promote retail investments in the stock market, and yet have no loss of Dividend Tax Revenue for the Govt