- Chandigarh UT

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

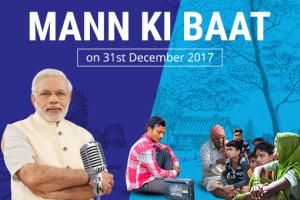

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

Share your ideas for PM Narendra Modi's Mann Ki Baat on 31st December

Start Date :

Dec 20, 2017

Last Date :

Dec 28, 2017

12:00 PM IST (GMT +5.30 Hrs)

As always, PM Narendra Modi looks forward to sharing his thoughts on themes and issues that matter to you. The Prime Minister invites you to share your ideas on topics he should ...

our MP(MEMBER OF PARLIAMENT) and MLA (MEMBER OF LEGISLATIVE ASSEMBLY) is not educated .So make rule or law for become mp and mla ,Minimum Qualification is (class 1 class 2 officer) or ias ips and ifs...

Suggestion of collection of indirect Tax (GST)

GST- Government should give assurance in GSTRule to the GST payer that he will get Loan for the amount of total GST amount paid till last GST payment( For Individual/Companies),It means GST payer should understand that GST payment is not wastage, this amount is directly linked with the GST payee only. Every body would like to purchase the material or services under GST. Today User is thinking that we paid average 28%/18% GST & it is a burden.

In continuation of below feedback

We appreciate several step taken by the government to stop corruption and bring back country economy on right track. However experience of voters getting effected with poor service from the officers and employees. Request necessary steps to help people for joining country development initiatives otherwise it will give negative impact in 2019.

Suggestion of collection of direct Tax (income tax) Income Tax- Government should give assurance in ITRule to the tax payer that he will get insurance for the amount of total income tax paid, dependent will get income 5% per annum of the total tax paid if tax payer expired before age of 60 years. If tax payer not expired then 2.5% after the age of 60 years. It means tax payer should get income from income tax department on the basis of total income tax paid. It is benificial to tax payer only.

But attack is also belongs to deaths,may we allow whole world to attack by non violence or without bombs or missile, like allowed attack is attack of dialogues.

In continuation of below feedback

I have went their to update mobile no after enquiry at 3 counter have been advised to take form from Security and submit. I went to security and he told that form is finished come tomorrow. I have tried to see officer but told that please bring document. I have told that as per you no document required for phone no update. They have not listen and given suggestion form for feedback. Final I am back to home. This is respect given to a taxpayer of country.

It is famous for India, we shall not attack first, but sometimes, we think, this is best possible condition for attack. My suggestion for attack is, this is time for world collaboration, we should ask hundred countries whether they can attack in similar condition or not, if they can attack means it is hidden permission of united nations for attack.

Dear Sir,

My suggestion on problem of the countrymen related to Aadhar service provider agency as well as central Government Employees.

Brief of problem faced by the people

In Patna, city office for Aadhar is in Lalit Bhavan Bailey Road @ 4th Floor where only stairs are the option to reach office which is difficult for old age and physically challenge people. They are not giving form for correction in address & mobile no. With this approach sentiment of public is against Gov.

To establish new company/factory project clearance time in india around 30 days but some of other countries it is only 1 or 2 days and company should have all clearances before start to establish the company.

Suggestion for creating employment

I visited at google map of some developed countries and saw that around every village there is two - three or more factories/companies are there. IF same thing we implement in our country it will help to generate new employment and will help to stop migration of people in search of employment. It will help to develop local/rural areas also.