- चंडीगढ़ संघ राज्य क्षेत्र

- रचनात्मक क्रियास्थल

- दादरा नगर हवेली केन्द्रीय शासित प्रदेश

- दमन और दीव केन्द्रीय शासित प्रदेश

- प्रशासनिक सुधार और लोक शिकायत विभाग

- जैव प्रौद्योगिकी विभाग

- व्यापार महकमा

- उपभोक्ता मामले विभाग

- औद्योगिक नीति और संवर्धन विभाग

- डाक विभाग

- विज्ञान और प्रौद्योगिकी विभाग

- दूरसंचार विभाग

- डिजिटल भारत

- आर्थिक मामले

- एक भारत श्रेष्ठ भारत

- ऊर्जा संरक्षण

- व्यय प्रबंधन आयोग

- खाद्य सुरक्षा

- गांधी@150

- बालिका शिक्षा

- सरकारी विज्ञापन

- हरित भारत

- अतुल्य भारत!

- इंडिया टेक्सटाइल

- भारतीय रेल

- Indian Space Research Organisation - ISRO

- रोज़गार निर्माण

- LiFE- 21 दिन का चैलेंज

- मन की बात

- मैला ढ़ोने की प्रथा से मुक्त भारत

- पूर्वोत्तर क्षेत्र विकास मंत्रालय

- कृषि और किसान कल्याण मंत्रालय

- रसायन और उर्वरक मंत्रालय

- नागरिक उड्डयन मंत्रालय

- कोयला मंत्रालय

- कारपोरेट कार्य मंत्रालय

- संस्कृति मंत्रालय

- रक्षा मंत्रालय

- पृथ्वी विज्ञान मंत्रालय

- शिक्षा मंत्रालय

- Ministry of Electronics and Information Technology

- पर्यावरण, वन और जलवायु परिवर्तन मंत्रालय

- विदेश मंत्रालय

- वित्त मत्रांलय

- स्वास्थ्य और परिवार कल्याण मंत्रालय

- गृह मंत्रालय

- आवास और शहरी मामलों के मंत्रालय

- सूचना और प्रसारण मंत्रालय

- जल शक्ति मंत्रालय

- कानून और न्याय मंत्रालय

- सूक्ष्म, लघु और मध्यम उद्यम मंत्रालय (MSME)

- पेट्रोलियम और प्राकृतिक गैस मंत्रालय

- ऊर्जा मंत्रालय

- सामाजिक न्याय और अधिकारिता मंत्रालय

- सांख्यिकी एवं कार्यक्रम क्रियान्वयन मंत्रालय

- इस्पात मंत्रालय

- महिला एवं बाल विकास मंत्रालय

- माईगव मूव - वॉलंटियर

- नई शिक्षा नीति

- न्यू इंडिया चैंपियनशिप

- नीति आयोग

- भारत के विकास के लिए एनआरआई

- ओपन फोरम

- PM Live Events

- राजस्व और जीएसटी

- ग्रामीण विकास

- सांसद आदर्श ग्राम योजना

- सक्रिय पंचायत

- कौशल विकास

- स्मार्ट सिटी

- भारत में खेलकूद

- स्वच्छ भारत

- जनजातीय विकास

- जलागम प्रबंधन

- राष्ट्र निर्माण में युवाओं की भागीदारी

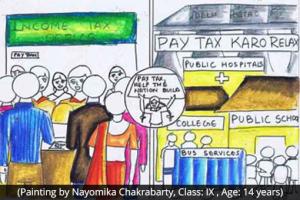

कर नीति और प्रशासन के संबंध में नवीन विचार एवं सुझाव देने के लिए आमंत्रण

आरंभ करने की तिथि :

Sep 18, 2015

अंतिम तिथि :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

सरकार की एक प्रमुख प्राथमिकता एक अनुकूल एवं एक संवेदनशील कर प्रशासन ...

CIBIL WAS A VERY INNOVATIVE IDEA BROUGHT UPON BY PREVIOUS GOVERNMENTS, BUT SINCE IT HAS PROVEN TO BE THIS EFFECTIVE , AND NOW IT POSSESS VERY SENSITIVE INFORMATION OF ALMOST 20% CITIZENS OF OUR COUNTRY,

WILL IT NOT BE A GOOD IDEA TO HAVE OUR OWN CIBIL TYPE AGENCY, AND NOT DEPENDENT ON A FOREIGN ENTITY TO SERVE OUR FINANCIAL INSTITUTIONS . CIBIL IS A FOREIGN COLLABORATION COMPANY IN ASSOCIATION WITH "DUN & BRADSTREET AND TRANSUNION " WORKING IN INDIA, WHEN WE ARE SO KEEN ON "MAKE IN INDIA"

In the case of an assesse offering income from house property, 30% deduction is allowed u/s 24 towards repairs/maintenance. However, in the case of employees who reside in own house entire HRA is taxed subject to the conditions laid down in Sec 10(13A). It would be highly desirable if 30% deduction is allowed on sum so calculated u/s 10(13A) because the employees should not be deprived of the deduction on account of repairs/maintenance. Request Hon'ble FM Sir to kindly consider.

It is really impossible to track Income Tax on local shopkeeper unless people are not asking for original bill

Original Bill again puts additional cost to consumer

If govt developed reimbursement model for additional charged amount to consumer using their AADHAR CARD then they will be able to get local-shopkeeper into their TAX-net

Reimbursement can be done through the additional govt revenue

It'll be almost similar to Gas subsidy

And mandatory original bill for consumers else penelty

To widen the tax net , innovatuve methods must be explored , there must be some curb upon farmers, they do not pat any taxes, but are always in center of government policies.

NPS's maturity proceedings can be easily made tax free as a better part is invested n equity and long term capital gain on equity investment is tax free , going through that logic nps return can be treated as return from hybrid mutual fund and can be taxed at par with hybrid mutual funds. Yes , pension earned with nps corpus may get taxed. But not the whole accumulated fund of nps

Interest on income tax refund must be exempted from Income Tax... it is like you are paying interest, (much lesser than prevailing loan rates) on my money kept with you, (not with my happy consent) and when i get my money back , i have to pay you back tax on that interest earned . Either you reduce TDS rates for those who are getting Refund in earlier year, or pay higher interest, or "exempt the interest, like exepmtion done on savings account interest"

NPS.. a good social security scheme for unorganized sector.. It used to contribute 1000.00 from govt's side in subscribers account for first 2-3 years, it was a better incentive to lure more and more subscribers, but currently it is discontinued.. it should be started again

before applying for PAN, one thinks of possibility, of ending up start paying income tax. there must be some incentive in applying for PAN . Like say "for first year itr, tax abatement of RS 1k or so."

These kind of incentives are seen on online shopping websites, "your first order with us.. have 100 Rs off on any purchase"

Our taxation about DIVIDEND Capital Gain Is no way different than what is in USA.When thie decision was our computerisation was infancy but today it is far advance.The Suggestion made earlier will not change much the DIV tax collection or on capital gain.Rather it will increase with passing of time and Companies will have funds for investment,and could consider higher distribution of Div per share.The real beneficiary of present rule will have to pay taxes.Stock sale market behavior up& down.

A suggestion is that let the Dividend Tax be taxable at the Investor level, with retail investors exempt from it (eg Dividend upto Rs 3000/- is exempt), and higher dividends being deducted @Tax rate by the company and given to the Govt.

This will allow the company to have a) more funds to fuel growth through their own profits, b) curb profiteering by a few investors and promote retail investments in the stock market, and yet have no loss of Dividend Tax Revenue for the Govt