- चंडीगढ़ संघ राज्य क्षेत्र

- रचनात्मक क्रियास्थल

- दादरा नगर हवेली केन्द्रीय शासित प्रदेश

- दमन और दीव केन्द्रीय शासित प्रदेश

- प्रशासनिक सुधार और लोक शिकायत विभाग

- जैव प्रौद्योगिकी विभाग

- व्यापार महकमा

- उपभोक्ता मामले विभाग

- औद्योगिक नीति और संवर्धन विभाग

- डाक विभाग

- विज्ञान और प्रौद्योगिकी विभाग

- दूरसंचार विभाग

- डिजिटल भारत

- आर्थिक मामले

- एक भारत श्रेष्ठ भारत

- ऊर्जा संरक्षण

- व्यय प्रबंधन आयोग

- खाद्य सुरक्षा

- गांधी@150

- बालिका शिक्षा

- सरकारी विज्ञापन

- हरित भारत

- अतुल्य भारत!

- इंडिया टेक्सटाइल

- भारतीय रेल

- Indian Space Research Organisation - ISRO

- रोज़गार निर्माण

- LiFE- 21 दिन का चैलेंज

- मन की बात

- मैला ढ़ोने की प्रथा से मुक्त भारत

- पूर्वोत्तर क्षेत्र विकास मंत्रालय

- कृषि और किसान कल्याण मंत्रालय

- रसायन और उर्वरक मंत्रालय

- नागरिक उड्डयन मंत्रालय

- कोयला मंत्रालय

- कारपोरेट कार्य मंत्रालय

- संस्कृति मंत्रालय

- रक्षा मंत्रालय

- पृथ्वी विज्ञान मंत्रालय

- शिक्षा मंत्रालय

- Ministry of Electronics and Information Technology

- पर्यावरण, वन और जलवायु परिवर्तन मंत्रालय

- विदेश मंत्रालय

- वित्त मत्रांलय

- स्वास्थ्य और परिवार कल्याण मंत्रालय

- गृह मंत्रालय

- आवास और शहरी मामलों के मंत्रालय

- सूचना और प्रसारण मंत्रालय

- जल शक्ति मंत्रालय

- कानून और न्याय मंत्रालय

- सूक्ष्म, लघु और मध्यम उद्यम मंत्रालय (MSME)

- पेट्रोलियम और प्राकृतिक गैस मंत्रालय

- ऊर्जा मंत्रालय

- सामाजिक न्याय और अधिकारिता मंत्रालय

- सांख्यिकी एवं कार्यक्रम क्रियान्वयन मंत्रालय

- इस्पात मंत्रालय

- महिला एवं बाल विकास मंत्रालय

- माईगव मूव - वॉलंटियर

- नई शिक्षा नीति

- न्यू इंडिया चैंपियनशिप

- नीति आयोग

- भारत के विकास के लिए एनआरआई

- ओपन फोरम

- PM Live Events

- राजस्व और जीएसटी

- ग्रामीण विकास

- सांसद आदर्श ग्राम योजना

- सक्रिय पंचायत

- कौशल विकास

- स्मार्ट सिटी

- भारत में खेलकूद

- स्वच्छ भारत

- जनजातीय विकास

- जलागम प्रबंधन

- राष्ट्र निर्माण में युवाओं की भागीदारी

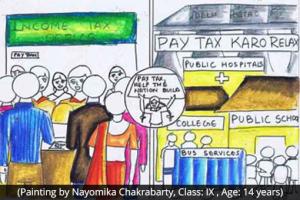

कर नीति और प्रशासन के संबंध में नवीन विचार एवं सुझाव देने के लिए आमंत्रण

आरंभ करने की तिथि :

Sep 18, 2015

अंतिम तिथि :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

सरकार की एक प्रमुख प्राथमिकता एक अनुकूल एवं एक संवेदनशील कर प्रशासन ...

SIR I AM AN ASSISTANT COMMISSIONER EXCISE AND TAXATION PURSUING PG DIPLOMA IN CYBER LAW FROM NALSAR HYDERABAD WORKING WITH GOVT OF HIMACHAL PRADESH.I WANT TO SUGGEST ON THE PRESENT STATE OF TAX ON E-COMMERCE.

1.THE GOVT OF INDIA HAS ADOPTED THE IT ACT-2000 IN PURSUANCE TO THE UN RESOLUTION NO-A/RES/51/162 DTD 30TH. JAN,1997 TO PROVIDE LEGAL RECOGNITION TO THE TRASANCTIONS MADE UNDER E-COMMERCE.

2.E-COMMERCE IS NOT NEGOTIABLE NOW AS IT IS A WORLD WIDE LEGAL ISSUE AND THE TRADE IS NOT ...CONTD..

I'm a CA student and right now undergoing articleship under an auditor. We use to visit IT office many times. Few things I noticed in IT office and also got to know through my friends that it is normal in all IT office.

1. Presence of ITO during office hours are rare and they reason would be that he have gone out for office related work but reality is different.

2. Bribe taking have become so normal that even a low level peon ask for 10 to 50 rupees to accept the letter or the itr forms etc..

Fourthly, initially taxing people and filing for returns not just consumes times but wastes man power for unnecessary things. It should be filed once and not move in circles.

First of all, given today's scenario most of the transaction should be digitalised. All transactions above a certain value should be direct transfer, say 5000.

Secondly, notes of bigger denomination should be demonetized, it will be a bigger incentive to transact using plastic money and money routes can be traced after that easily.

Thirdly, income tax base should be broad, till how long will just 3% population bear the burden of developing the entire country?

Sir i am working in PSU and getting salary every month after deduction of tax. Again giving tax while buying any thing or use any service. Now a days tax rebate range should be changed. In my view it should be like this (1) 0-5 lakh 0%. 5-10 lakh 10%. (2) 10 to 20 lakh 20%. (3) 20 lakh above 30%.

Efficient use of public fund can reduce tax burden. A transparent e governance system with 360 degree appraisal approval from end user or beneficiaries should be in place to make fund utilization leak proof. This will reduce the cost of public project or scheme and will help in reducing tax burden on public which is being collected and emposed by goverment for public welfare development.

I just want you to take tax not according to total annual income but on the basis of facilities the person is getting. I belongs to small city where roads are full of garbage, animals and broken. You can't walk out of your home without covering your nose with handkerchief. Subways are filled with water and citizens are suffering from it. How a tax-payer can give so much tax without having common facilities whereas Chandigarh same income group families pays same tax and enjoying. I am from Ambala

ONLY GOVT.EMPLOYEES PAYING TAX. BECAUSE IT IS ON PAPER AND WHITE MONEY, YOU CANT HIDE. IN INDIA MAXIMUM PEOPLE SMALL BUSINESSMAN TO BIG BUSINESSMAN ARE EARNING EQUALLY OR 10 TIMES OF MORE THAN GOVT. EMPLOYEES. BUT NETHER THEY ARE PAYING TAX OR SHOWING INCOME TO GOVT& GOVT IS LOOSING CRORES OF RUPEES. INCREASE PRESENT SLAB 2.5LAKHS TO 5LAKHS, AND SVINGS 1.5 TO 2LAKHS, SO GOVT.EMPLOYEES WILL GET BENFIT. INFLATION IS MOREAND EXPENDITURE IS MORE FOR DAY TO DAY LIFE.

Respected PM Sir

Income tax slab should be revised.

No tax up to 1200000

10% above 12

20% above 25

25% above 50 Lakh

30% above 75 Lakh

top 1000000 Assesee and tax payer in individual capacity should be nationally honoured and VIP status to be given

PAN details to be mandatory at All Purchase and Sales deal above 100000.

Raise the cash transaction limit to 100000

Fix limit of cash in hand per individual to 100000. If any individual have more than 100000lakh , keep in bank.

Please reduce income tax slab to 2-5%...... please apply tax above 10k income.... Let everyone pay tax promptly. according to Indian media Only 3% of Indian populace pays Income Tax. huh. I think only salaried class people are paying tax promptly. Even govt should think to collect sales tax and vat promptly. Govt should start providing sealed billing machines(which are connected by network)for business establishments. They are collecting ST/vat from us, but not paying to govt propmtly