- चंडीगढ़ संघ राज्य क्षेत्र

- रचनात्मक क्रियास्थल

- दादरा नगर हवेली केन्द्रीय शासित प्रदेश

- दमन और दीव केन्द्रीय शासित प्रदेश

- प्रशासनिक सुधार और लोक शिकायत विभाग

- जैव प्रौद्योगिकी विभाग

- व्यापार महकमा

- उपभोक्ता मामले विभाग

- औद्योगिक नीति और संवर्धन विभाग

- डाक विभाग

- विज्ञान और प्रौद्योगिकी विभाग

- दूरसंचार विभाग

- डिजिटल भारत

- आर्थिक मामले

- एक भारत श्रेष्ठ भारत

- ऊर्जा संरक्षण

- व्यय प्रबंधन आयोग

- खाद्य सुरक्षा

- गांधी@150

- बालिका शिक्षा

- सरकारी विज्ञापन

- हरित भारत

- अतुल्य भारत!

- इंडिया टेक्सटाइल

- भारतीय रेल

- Indian Space Research Organisation - ISRO

- रोज़गार निर्माण

- LiFE- 21 दिन का चैलेंज

- मन की बात

- मैला ढ़ोने की प्रथा से मुक्त भारत

- पूर्वोत्तर क्षेत्र विकास मंत्रालय

- कृषि और किसान कल्याण मंत्रालय

- रसायन और उर्वरक मंत्रालय

- नागरिक उड्डयन मंत्रालय

- कोयला मंत्रालय

- कारपोरेट कार्य मंत्रालय

- संस्कृति मंत्रालय

- रक्षा मंत्रालय

- पृथ्वी विज्ञान मंत्रालय

- शिक्षा मंत्रालय

- Ministry of Electronics and Information Technology

- पर्यावरण, वन और जलवायु परिवर्तन मंत्रालय

- विदेश मंत्रालय

- वित्त मत्रांलय

- स्वास्थ्य और परिवार कल्याण मंत्रालय

- गृह मंत्रालय

- आवास और शहरी मामलों के मंत्रालय

- सूचना और प्रसारण मंत्रालय

- जल शक्ति मंत्रालय

- कानून और न्याय मंत्रालय

- सूक्ष्म, लघु और मध्यम उद्यम मंत्रालय (MSME)

- पेट्रोलियम और प्राकृतिक गैस मंत्रालय

- ऊर्जा मंत्रालय

- सामाजिक न्याय और अधिकारिता मंत्रालय

- सांख्यिकी एवं कार्यक्रम क्रियान्वयन मंत्रालय

- इस्पात मंत्रालय

- महिला एवं बाल विकास मंत्रालय

- माईगव मूव - वॉलंटियर

- नई शिक्षा नीति

- न्यू इंडिया चैंपियनशिप

- नीति आयोग

- भारत के विकास के लिए एनआरआई

- ओपन फोरम

- PM Live Events

- राजस्व और जीएसटी

- ग्रामीण विकास

- सांसद आदर्श ग्राम योजना

- सक्रिय पंचायत

- कौशल विकास

- स्मार्ट सिटी

- भारत में खेलकूद

- स्वच्छ भारत

- जनजातीय विकास

- जलागम प्रबंधन

- राष्ट्र निर्माण में युवाओं की भागीदारी

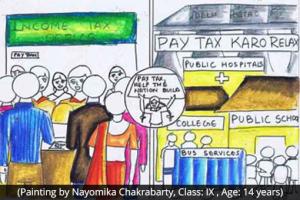

कर नीति और प्रशासन के संबंध में नवीन विचार एवं सुझाव देने के लिए आमंत्रण

आरंभ करने की तिथि :

Sep 18, 2015

अंतिम तिथि :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

सरकार की एक प्रमुख प्राथमिकता एक अनुकूल एवं एक संवेदनशील कर प्रशासन ...

It is very much needed that more people are to be made active contributors in the idea giving process. People need to be inspired by real freedom fighters during pre independence. All the people needed to be united for single cause. Like this no problems can be there any longer. Please hope for good rains this year. It is very much necessary.

Sorry 5 go 12 lac 20% tax

From Dr Jyoti Kapoor Typing mistake 5to12lac 10% tax.

1 to 2lac Rs 200 annually

Between 50000 to one lac charge Rs 100 annually as tax and again 1 go 2lac charge Rs 200 annually.2to 3lac Rs 300 and 3 to5 lac charge 10% 5 go @2 lac 20 % 12lac and above 30%.All those with less than 3lac income give discount on khadi products ,food items 5% or whatever on showing pancard.This way they will not spoil govt property and will get back the amount spent as tax.It will boost their moral and get feel for the nation. From Dr Jyoti Kapoor

Make in bond investment bond invested amount incresing 50000 limit i.e. investment more than 50000, interms of 5000 step, will be given as rewards points with 2 year validty. Fund can be categories like Defense, Civil infra, railways, water ways etc. For investment in Defense honorary certificate from defence can be given.

Also additional surcharge of make can be introduce in 30% and above tax bracket.

Add Make in India fund in income tax rebate:This may have different options like 1)EEE 7.5% for 3,5,15,20. with rebate in tax bracket;2) EEE with rewards point for invested amount exceeding given limit say Rs.50000 for investment. and rewards point can be utilised like credit card points or for next year exemption with validity upto 2years.

Hello sir..

Is in India lots of shopkeepers are not pay tax like .. Pan shop ,tea shop , kirana shop , Landry shop , they are also use all govt facilities and they are not pay any taxes.. If you are charges one years minimum amount so in India .. Maybe 1cr shops .. for example 1000 per year so 1000*1cr =?? Every years

earnings of govt.

Under the head 'lncome From House Property' is that, the assesse should be the owner of that house property”

As I am the sole earning member of the family, I had to apply for joint house loan for its completion along with my mother who is the owner of the house. The changing of ownership of the house has not been completed. As the new rule has come into force, I am not able to claim deduction in income tax, so I request for relaxations in the above rule.

- HRA deductions to be given on payment of this 1% tax deduction done and submitted to IT department.This will automatically force all home owners to declare rental income.

- Similarly TDS on bank interest would lead to increased compliance

- Bring back the standard deduction for salaried class to synchronize the income-based taxation on salaried class to profit-based taxation of corporate /business class

- Replace PAN with aadhar...this will lead to unification from multiplicity of numbers and also remove the complain of not enough people having PAN.

- Introduce a lower rate of TDS 1% for each income source -say bank interest, div payment, rental payments etc. This might lead to increased compliance .But, have a simplified procedure to file returns and claim back TDS